OP-ED – By Debo Adebajo: Vice President, Technical, Heirs Energies

Nigeria’s gas ambitions will not be delivered by policy declarations alone. They will be delivered by speed, precision and engineering ingenuity. The Agbada-67 intervention in OML 17 offers a compelling case study of how brownfield innovation can unlock stranded capacity, boost domestic gas supply and stabilise power generation, without drilling a single new well.

Re-engineering Gas Assets Accelerates Power Delivery

Nigeria has positioned gas as its transition fuel, but the challenge is delivering results. The nation lacks neither reserves nor strategies, only speed of execution. Bridging the gap between gas resources and reliable power depends less on new drilling and more on innovatively re-engineering existing assets.

Despite Africa’s largest proven gas reserves, the country still faces power shortages, industrial disruptions, and gas flaring, gaps that cannot be closed by policy intent or capital-intensive megaprojects. It requires practical, scalable engineering solutions that unlock value from existing assets, quickly, safely, and affordably.

In 2025, a rigless gas well intervention at Agbada-67 in OML 17 demonstrated what is possible when innovation meets constraint.

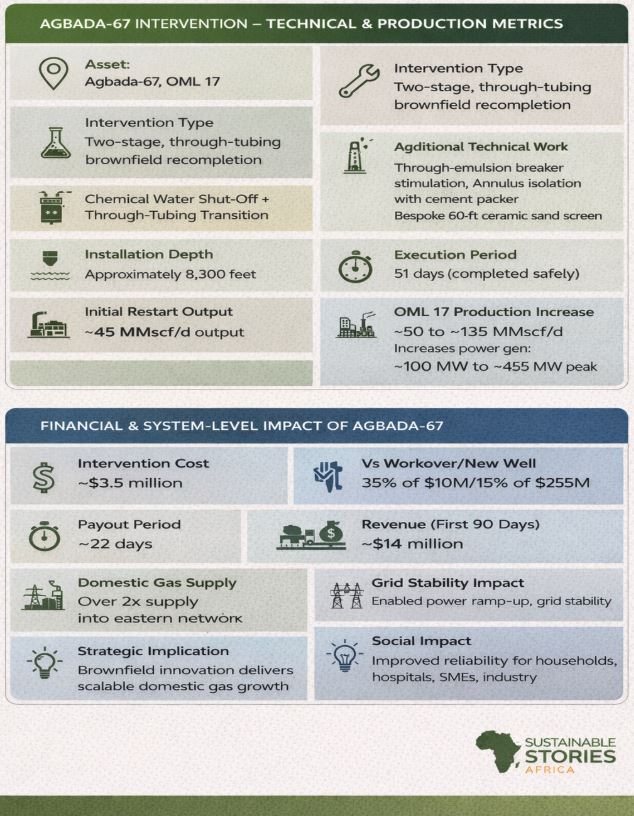

Through a carefully executed brownfield recompletion, the well was restarted with a gas output of approximately 45 million standard cubic feet per day (MMscf/d), contributing to a broader rise in OML 17 gas production from about 50 MMscf/d to a peak of 135 MMscf/d.

The impact was immediate: aggregate power generation across plants supplied from the eastern network increased from roughly 100 MW to over 325 MW on average, with peak generation reaching about 455 MW.

Why brownfields now matter more than ever

Nigeria’s upstream sector is undergoing a structural transition. With many international oil companies exiting, assets once developed under capital-intensive expansion models are now operated by indigenous firms facing tighter capital but greater pressure to boost production.

Historically, wells were drilled to target larger, deeper reservoirs, often bypassing shallower hydrocarbon-bearing zones. Over many decades, this approach has created a vast portfolio of completed and suspended wells, running across untapped or underutilised reservoirs. In the onshore Niger Delta alone, over 3,200 wells have been drilled, with more than 2,300 now completed or suspended.

This history presents a challenge and an opportunity, as while mature assets face declining production, targeted brownfield interventions offer a high-value, low-cost alternative to new developments.

The Agbada-67 technical approach

Agbada-67 was originally completed in a deeper gas reservoir and began experiencing water breakthrough in line with reservoir prognosis. Conventional responses would have involved drilling a new gas well at an estimated cost of about $25 million, or a full workover costing roughly $10 million.

Instead, the technical team pursued a third path: a two-stage, through-tubing recompletion – an approach that had not previously been executed in this combination on the asset.

The first stage involved a chemical water shut-off of the existing completion to enable access to a shallower reservoir. The second stage focused on recompleting the well through existing tubing, avoiding the need for a rig.

This included through-tubing perforation, reservoir stimulation using micro-emulsion breaker chemicals, isolation of the annulus from the surface with a cement packer, and the deployment of a bespoke ceramic sand screen 60 feet long, installed inside a 4½-inch tubing string at a depth of approximately 8,300 feet.

The entire operation was completed safely within 51 days.

The result was a recompleted gas well that delivered nearly double its initial production forecast, at strong reservoir pressures, and without expanding the field’s surface footprint.

Impact beyond the wellhead

For millions of Nigerians, this is not about infrastructure statistics; it is about lights staying on, hospital equipment functioning, and small businesses being able to operate without diesel generators.

This is why the significance of Agbada-67 lies not only in production numbers, but in its system-level impact.

In 2025, increased gas availability from OML 17 more than doubled supply into the eastern domestic gas network. Power plants dependent on this gas were able to ramp up generation, improving grid stability for households, hospitals, businesses, and industrial users. This is what gas monetisation looks like when it works, not as an abstract policy goal, but as electricity delivered.

Financially, the project also underscores the efficiency of brownfield innovation. The intervention cost approximately $3.5 million, around 35% of the conventional workover, and about 15% the cost of a new well. The payout period was roughly 22 days, with revenues of about $14 million generated within the first 90 days of production.

Replicability across Nigeria’s brownfields

Agbada-67 is the proof point.

Similar conditions exist across Nigeria’s mature fields, wells with existing infrastructure, declining reservoirs, and bypassed zones that can be accessed through creative recompletion strategies. The same approach is already being evaluated for nearby wells, including Agbada-68, which is expected to experience water breakthrough in the coming months.

More broadly, the lesson is clear: Nigeria does not need to wait for large greenfield projects to grow its gas supply. With the right technical mindset, regulatory support, and disciplined execution, brownfields can deliver meaningful volumes quickly and sustainably.

Aligning innovation with national priorities

Gas has been clearly identified as Nigeria’s transition fuel. Increasing domestic gas supply supports power generation, industrialisation, and emissions reduction by converting routine flares into productive use. However, delivering on this vision requires solutions that play out Nigeria’s current realities; solutions that are cost-effective, fast to deploy, and grounded in local engineering capability.

The success at Agbada-67 reflects what is possible when indigenous technical teams, working in partnership with NNPC and NUIMS, focus on practical problem-solving rather than textbook development models.

As Nigeria navigates the next phase of its energy transition, brownfield innovation should move from the margins to the mainstream of development planning. Regulators, operators, and investors all have a role to play in enabling these approaches through flexible frameworks, data transparency, and continued collaboration.

Agbada-67 shows that with the right tools and mindset, existing assets can deliver new value. The challenge now is to scale.