LAGOS, 23/04/2024 – Heirs Energies, Africa’s leading integrated energy company...

Read More

Interview: CEO, Osa Igiehon speaks on Heirs Energies’ growth journey with Global Business Report

Can you provide an overview of Heirs Energies and its...

Read More

Heirs Energies: Powering Nigeria’s Economy with Domestic Gas Supply

Sole Gas Supplier to Geometric Power Plant LAGOS, 07/03/2024 –...

Read More

Three Years of Remarkable Achievements

Since its bold entry into the Nigerian oil and gas...

Read More

Heirs Energies Celebrates Third Anniversary

Significant Milestones in Production Growth, Transformational Community Engagement, and a...

Read More

Full Speech of MD/CEO, Heirs Energies, Osa Igiehon at the 20th Anniversary/Induction Celebration of IPES, University of Port Harcourt

The Petroleum Industry in the Next 20 Years: Energy Transition...

Read More

Heirs Energies honoured for Sustainable Operations at NBLA 2023

Heirs Energies, an...

Read More

Heirs Holdings’ Oil & Gas Becomes Heirs Energies

Brand Positioning Demonstrates Heirs Holdings’ Integrated Energy Strategy LAGOS –...

Read More

Samuel Nwanze ED/CFO of Heirs Oil & Gas Highlights the Importance of FDI in Developing Africa’s Natural Gas Reserves at SPE NAICE 2023

Samuel Nwanze, the Executive Director/Chief Finance Officer of Heirs Oil...

Read More

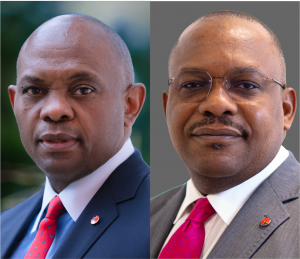

Chairman, HHOG, Tony O. Elumelu CFR, speaks on Local Capacity Development at the 2023 AVAR

Yesterday, the Chairman of HeirsHoldings Oil & Gas Limited, Tony...

Read More

Keynote speech at the Launch of APWEN SheEngineer 30% Club by MD/CEO, Osayande Igiehon: “Integration and implementation of gender-sensitive policies in the workplace”

Keynote Speech delivered by MD/CEO, Heirs Oil & Gas, Osayande...

Read More

Osayande Igiehon at the 2022 APWEN Conference : Just Energy Transition; An Enabler for Sustainable Development in Nigeria.

Speech delivered by MD/CEO, Heirs Oil & Gas, Osayande Igiehon ...

Read More

Heirs Oil & Gas Reiterates Commitment to Global ESG Best Practices

Doubles gas production capacity of OML 17 while upholding ESG...

Read More

Heirs Oil & Gas’ OML 17 wins PFI Africa Deal of the Year

HHOGs OML 17 deal awarded 2021 Project Finance International (PFI)...

Read More

Heirs Oil & Gas Announces Key Executive Management Appointment

Lagos, 20/08/21 - Heirs Oil & Gas (HHOG), the leading...

Read More

Heirs Oil & Gas Announces CEO and Board Appointments

Welcomes Former Senior Shell Executive, Osayande Igiehon, as CEO Lagos,...

Read More

Heirs Holdings $1.1bn OML 17 Deal Demonstrates Renewed Confidence in Nigerian Economy

The investment of over $1billion by Heirs Holdings in the...

Read More

BBC World Reports: Heirs Holdings $1.1bn OML 17 Deal Demonstrates Renewed Confidence in Nigerian Economy

The investment of over $1billion by Heirs Holdings in the...

Read More

Interview: Unpacking Heirs Holdings $1.1 billion OML -17 deal

Lagos, Nigeria, January 18, 2021 - On Arise News, the...

Read More

Heirs Holdings Significantly Expands Oil and Gas Portfolio

Acquires 45% of OML 17 from Shell, Total and ENI...

Read More